Since 1862, House of Julius Meinl companies have been independent and entrepreneurial forces in their respective industries. In parallel, the Julius Meinl family has sought to use its standing and influence for the benefit of its chosen causes

A Rich Legacy

From Investment to Prosperity

Entrepreneurial since 1862

Spanning Six Generations

Going back to the foundation of its business activities in 1862, the Meinl Family has been a family of merchants and investors.

Julius Meinl I

Julius Meinl I is the founder of the company of the same name. He is considered to be a pioneer of the coffee industry. The sale of freshly roasted coffee was first made possible by the roasting method he developed in 1862.

Julius Meinl II

Julius Meinl II was a successful businessman, who was also extraordinarily active on the political and social front. Under his management, his father’s simple food shop grew to become one of Austria’s leading companies.

Julius Meinl III

Julius Meinl III took over the family’s food company from his father Julius Meinl II in 1933 and continued to expand it across Europe. After Austria’s so-called “Anschluss” into Nazi Germany in 1938, he left the country and emigrated to England.

Julius Meinl IV

Julius Meinl IV joined the family business, Julius Meinl AG, as a member of the Supervisory Board. Established by his great-grandfather in 1862, Julius Meinl AG was one of the leading food retailing and food producing companies in Austria.

Julius Meinl V

Julius Meinl V heads House of Julius Meinl. The name Julius Meinl is synonymous with a family business, and the brand is one of the best known and most prestigious not only in Austria.

Julius VI

Julius Meinl VI was born in 1986. He has over 10 years of principal investment and entrepreneurial experience. Currently, Julius Meinl VI is a director of Julius Meinl Living, where his is driving the development and opening of the company’s initial aparthotels.

Doing Well By Doing Good

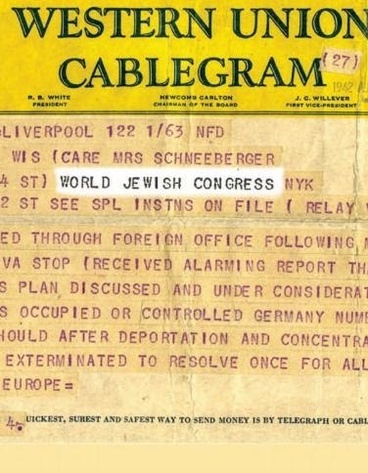

Julius Meinl V is actively engaged in Jewish philanthropy. He provides support to Jewish communal institutions in Austria, in particular, to the World Jewish Congress

Julius Meinl Living publishes its 2023 accounts

Julius Meinl Living: Consolidated 2023 Accounts and Acquisition

Julius Meinl Living PLC, through its group companies, acquires prime real estate assets in major European political and economic capital cities for development into top rated hotel properties that comprise mainly apartments…

Hamas invaded Israel to murder Jews, not for Palestinian statehood - opinion

The Nazis hated Jews because they were Jews. They murdered Jews because they were Jews. And Hamas did too.

Julius Meinl Living publishes its 2022 accounts

Julius Meinl Living publishes its consolidated 2022 accounts

Julius Meinl Living PLC, through its group companies, acquires prime real estate assets in its core markets for development into serviced residences that the group will then operate itself (“Julius Meinl Living”).

"The Julius Prague" will Open Officially in July

On 4 July 2022, The Julius, a new international hospitality brand from the Julius Meinl family, will officially open its inaugural location, which is designed by Matteo Thun & Partners

Julius Meinl Living publishes its 2021 accounts

Julius Meinl Living publishes its consolidated 2021 accounts

Julius Meinl Living PLC, through its group companies, acquires prime real estate assets in its core markets for development into serviced residences that the group will then operate itself (“Julius Meinl Living”).

KEX Confectionery Confirms the Salvation of Salzburg Schokolade

The financial restructuring of Salzburg Schokolade is complete and an agreement has been reached with Mondelēz. Salzburg Schokolade can now move forward with confidence.

Julius Meinl Living launches "The Julius" brand

Julius Meinl Living reveals its brand strategy. The company's flagship properties will be known as “The Julius”

Julius Meinl am Graben reopens after a comprehensive renovation

On 22nd October 2021, Julius Meinl am Graben reopened after a comprehensive renovation.

Completely new shopping experience at Austria's top address for delicatessen - logo and corporate colours have also been modernized.

Julius Meinl Living aquires operating aparthotel in Budapest

Julius Meinl Living PLC, through its group companies, acquires prime real estate assets for development into serviced residences that the group will then operate itself (“Julius Meinl Living”).